Business Loan Calculator

Use our SME Business Loan Calculator below to find out how much you can borrow to take your business to the next level.

Want to understand the cost of your loan?

Use our business loan calculator below to find out how much you can borrow to take your business to the next level.

Calculations are indicative only and intended as a guide only. The figures calculated are not a statement of the actual repayments that will be charged on any actual loan and do not constitute a loan offer.

Monthly payments

-

Monthly interest

-

Total interest

-

Length of loan

-

Total cost of loan

-

About this business loan calculator

Looking to estimate monthly repayments or overall costs for a business loan? With 43% of UK SMEs using external finance to fuel growth, our calculator helps UK businesses – from startups to established companies – gain a clearer picture of potential borrowing costs.

Get accurate estimates in seconds for loan amounts from £1,000 to £20 million, whether you’re seeking a small business loan, a commercial property mortgage, or asset finance to invest in new equipment.

No obligation, no impact on your credit score – just a clear, reliable calculation to help plan your business funding. Please note that the results are indicative only.

How our business finance calculator works

- Planning to take out a business loan is simple with Funding Options by Tide. Our Business Loan Repayment Calculator gives you an instant estimate so you can budget with confidence and compare your options before committing to a lender.

- Enter the loan amount: Estimate how much you plan to borrow – from £1,000 to £20 million

- Select the interest rate: Our business loan rates calculator allows you to adjust the interest rate assumption to see how it might affect your monthly and total repayments.

- Choose your repayment term: Decide whether you need short-term funding (59% of applicants choose two years or less) or a longer-term solution to spread out the cost.

- Review your repayments: The calculator shows estimated monthly costs, total interest, and overall repayment amounts to help you understand the true cost of borrowing.

You can use our business loan monthly payment calculator to calculate business loan repayments and plan your budget with confidence.

Please note that all results are indicative and may vary depending on the actual terms offered by your chosen lender.

Understanding your business loan calculator results

- Your calculator results show three key figures that determine whether a business loan works for your budget:

- Monthly payments: This is the total amount you’ll need to repay each month, including both the principal (the original loan amount borrowed) and interest.

- Monthly interest: This is the portion of your monthly payment that goes toward interest charges. In the early months of your loan, a larger portion goes to interest, while later payments focus more on reducing the principal balance.

- Total interest: This is the total amount of interest you’ll pay over the duration of the loan. Even a 1-2% difference in interest rates can save you thousands on larger loans!

- Length of loan: This is the total number of months that you’ll repay the loan over. Longer-term lengths should mean lower monthly payments, but they’ll also typically result in higher total interest.

- Total cost of loan: This is the total amount you’ll pay over the duration of the loan, including the initial principal amount and total interest.

Your calculator results can help you answer the question, “How much will my business loan cost?” And it’ll help ensure you’re making a decision based on complete information, not just the headline interest rate.

Tip: Focus on both monthly affordability (can your cash flow handle the payments?) and total cost (is the overall expense justified by your business needs?) A suitable loan should balance both manageable monthly payments and reasonable total costs.

Startup business loan calculator options

- Business owners, finance managers, and accountants often use a startup business loan calculator to understand how repayments might fit into their cash flow projections. It’s particularly important for new businesses working with limited revenue and unpredictable income.

- New businesses often face higher interest rates due to a more limited trading history

- The government’s Start Up Loans scheme offers fixed 6% rates for loans up to £25,000

- Consider how seasonal revenue might affect your ability to make consistent payments

- Factor in a cash flow buffer as many startups underestimate their working capital needs

Whether you’re launching a tech startup, opening a local retail shop, or expanding your services, getting a clear estimate of borrowing costs early can help you plan effectively.

For limited companies, a limited company loan calculator might factor in extra factors like corporate tax and business structures.

Things for startups to consider:

You can use our small business loan calculator to compare different scenarios, from conservative growth projections to more optimistic expansion plans.

Calculators to compare different business loan options

A variety of different business loan calculators exist to help you compare different types of funding and find the right solution for your needs.

Secured vs. unsecured business loan calculator

Secured business loans require assets (eg property, vehicles, or equipment) as collateral. This reduces the risk for lenders, usually resulting in lower interest rates and access to larger borrowing amounts. A secured vs. unsecured business loan calculator can help you compare how collateral can reduce your monthly payments.

Unsecured business loans don’t need security but generally come with higher interest rates. They’re ideal for businesses that don’t have significant assets or when you don’t want to risk valuable business assets. A secured vs. unsecured business loan calculator can show the premium you might pay for this flexibility.

Business loan calculator for bad credit UK companies

- If your business has a poor credit history, a business loan calculator for bad credit can help you plan realistic scenarios. Bad credit business loans typically have high interest rates, but they can help rebuild your credit profile so long as you make consistent repayments.

- Check your credit report before applying

- Consider smaller loan amounts

- Factor in the potential for refinancing at better rates once your credit improves

To improve your credit rating and get access competitive interest rates:

To find out what your business credit score is and what’s affecting it, you can use our Credit Score Insights product. As well as learning about your score, you’ll also receive tips to improve it. It’s simple, affordable and easy to use.

Business loan interest calculator for UK companies

- Interest rates can vary a lot based on the type of loan, term, and your unique business profile. A business loan interest calculator can help you understand how different rates might impact your costs:

- Fixed rates: Provides consistent monthly payments for easier budgeting

- Variable rates: Typically the lowest interest rate deal but can increase (or decrease) at any time

- Bank base rate impact: The rate set by the Bank of England influences all business lending rates

Commercial loan repayment calculator

- A commercial loan calculator can provide insights into monthly commitments for very big projects like buying warehouses, expanding operations, or acquiring other businesses. It can estimate how different interest rates and term lengths could affect the total cost of a major investment.

- Loans over £250,000 often require personal guarantees

- Longer terms (5-25 years) can spread costs but increase total interest

- You can use commercial property as security to potentially reduce the interest rate

- Factor in extra costs like legal fees and valuations

When considering a commercial loan, consider:

Business mortgage calculator / commercial property mortgage calculator

- For businesses that want to buy or refinance commercial real estate, a business mortgage calculator or commercial property mortgage calculator can help you estimate the monthly repayments and compare the costs of property ownership against renting.

- Principal and interest payments

- Additional costs (eg legal fees, surveys, and insurance)

- Deposit amounts

- Long-term cost comparisons (eg buying vs. renting over 25 years)

This calculator will help you work out:

Asset finance calculator

- Are you looking to buy equipment, vehicles or machinery but don’t want to tie up working capital? Our Asset Finance Calculator can estimate your monthly repayments based on asset costs and lease/hire purchase terms. You can use it to see your options for maintaining cash flow for your daily operations.

- An asset serves as security

- Typically lower interest rates (secured loan)

- Asset-specific terms

- Ownership of purchases may transfer at term end Business loan

- May need separate collateral

- Typically higher interest rates (unsecured loan)

- Flexible use of funds

- Immediate ownership of purchases An asset finance calculator can show you how spreading the cost of equipment can preserve your working capital for growth opportunities while also allowing you to access the equipment your business needs to grow.

Comparing asset finance vs. business loan calculators:

Asset finance

Merchant cash advance calculator

If you’re in need of quick access to capital and are happy to repay through a percentage of future credit card sales, the Funding Options by Tide Merchant Cash Advance Calculator could help.

It helps you estimate the cost and repayment schedule of a merchant cash advance (MCA) to see if it’s suitable for your business.

Compared to a traditional business loan, MCAs are quick and flexible, and you won’t need to put down collateral or pass a credit check. But they’re also typically more expensive than traditional business loans and can strain cash flow if sales are low.

Revolving credit facilities calculator

If you need flexible access to capital that you can draw upon and repay as needed, you can use the Funding Options by Tide Revolving Credit Facilities Calculator to estimate the monthly repayments, interest and total cost to see if an RCF is right for your business.

Unlike traditional loans, RCFs work like a business credit card with higher limits - you only pay interest on what you borrow and can reuse the credit once repaid. But they typically come with arrangement fees and you’ll need to monitor it carefully to manage the costs effectively.

Invoice finance vs. business loan calculator

- If you’re not sure whether to choose between invoice finance and a traditional business loan, a comparison calculator can help you evaluate the merits of both options.

- Invoice finance typically costs 1.5-3% of the invoice value but provides immediate cash flow without having to take on debt

- Business loans offer a cash lump sum but require regular repayments regardless of your sales An invoice finance calculator vs. business loan calculator can help you model different scenarios based on your invoice volumes and payment terms to see which option provides better cash flow for your business.

When to use a business loan repayment calculator

- A business loan calculator can be useful in lots of ways:

- Pre-application planning: 49% of businesses say that finding financing has become more challenging in recent years. So using a business loan calculator to estimate costs more accurately can strengthen your applications and help you target the most suitable lenders.

- Cash flow forecasting: This is particularly important for seasonal businesses that need to model repayments against their varying monthly income. Restaurants, retail, and tourism businesses can particularly benefit from using a business loan calculator.

- Comparison shopping: Instead of accepting the first offer you receive, try using a business loan comparison calculator to compare different quotes. The information could help you negotiate a more competitive deal.

- Growth planning: When opportunities to expand come up, you can use a business loan calculator to quickly model the impact of different loans on your monthly cash flow and make a more informed decision.

- Emergency preparedness: Pre-calculating various loan scenarios can help you respond quickly when there’s an unexpected need for funding. This can be extremely useful, considering that 91% of businesses finance applicants need funding “as soon as possible.”

How to get the most accurate results from a business loan calculator

- A business loan calculator can help you compare different financing options and understand what you’ll actually pay. But these calculations are only as good as the information you put into them. Get the figures wrong, and you could end up with misleading or even damaging results for your business. So, how do you make sure you get the most accurate results possible?

- Gather accurate information: Before you use a business loan calculator, collect all the information you’ll need (and make sure it’s accurate). This can include the exact loan amount you want to borrow, the interest rate you may be offered (which can vary widely), how long you want the repayment term to be, and any extra fees you’re aware of (e.g. arrangement or origination fees). Small mistakes can result in big inaccuracies.

- Use a trusted calculator: Choose a business loan calculator from a site you trust. This will help make sure the tool is up to date and can be relied upon for accurate results.

- Input details precisely: It sounds basic, but take your time entering the figures correctly. Small mistakes, such as putting a decimal point in the wrong place or adding an extra zero could result in misleading results!

- Consider tax implications: If you use a business loan calculator with tax considerations, it can help you understand how loan interest (typically tax-deductible for businesses) can affect your overall business costs.

- Interpret the results carefully: Review the monthly repayment amount, total interest paid, and total repayment amount carefully. Compare the figures with your cash flow to see if the loan would be affordable and aligns with your long-term financial goals.

- Compare different scenarios: There’s no limit to the number of times you can use a business loan calculator. So feel free to compare as many scenarios as is helpful. Adjust things like the loan amount, interest rate, and term to see how each change might affect your repayments and total costs. Taking your time to compare lots of options can help you find the most suitable loan for your needs, and it will prepare you for conversations with lenders.

Find business finance with Funding Options by Tide

Whether you’re looking for a standard business loan, a short-term business loan, or something a little more specialist, like auction finance for property developers, we’re one of the leading names in business finance in the UK, having helped facilitate over £800 million in finance to more than 18,000 customers.

Checking if you’re eligible is free, only takes a few minutes, and while a full application would impact your personal or business credit score, checking eligibility won’t. Just submit your details via the link below to find out if you could be eligible to borrow up to £20 million.

Find business finance.

FAQs

How accurate is a business loan calculator?

The Funding Options by Tide Business Loan Calculator provides realistic estimates based on current market conditions and typical lending criteria. Your actual rates will depend on factors like your credit profile, business performance, trading history, and chosen lender. The calculator uses market averages to give you a solid foundation for planning, but you should always confirm the exact terms with lenders before making final decisions.

Can I use a business loan calculator with bad credit?

Yes, our calculator works for all credit situations. But if your business has challenges with credit, you should expect interest rates to be higher than the standard market averages shown. Bad credit business loans are available through specialist lenders in our network, and using the calculator can help you plan a realistic budget. Remember that consistent repayments on any loan can help rebuild your credit profile over time.

What’s the difference between APR and interest rate in calculations?

The interest rate is the annual cost of borrowing the money. APR (Annual Percentage Rate) includes interest plus all mandatory fees like arrangement costs, admin charges, and required insurance – this gives you the ‘true cost’ of borrowing. Always compare APRs rather than just interest rates when you’re looking at different loan options.

How can I calculate business loan repayments manually?

Calculating your own business loan repayments manually can be complex, relying on difficult mathematical formulas. That’s why we built the Funding Options by Tide Business Loan Calculator to handle all scenarios automatically. Our calculator helps you save time and reduce errors, allowing you to compare multiple loan options and adjust details to find the most suitable fit for your business.

Does using a business loan calculator affect my credit score?

No, using a business loan calculator has no impact on your credit score whatsoever. Your credit score may be affected when you submit a formal application to lenders. But you can use the Funding Options by Tide Business Loan Calculator as many times as you need to explore different scenarios without any impact on your credit history.

Can I get funding if my calculator results show I need a large loan?

Funding Options by Tide can help your business access the viability of a wide range of funding sizes through our network of over 120 lenders, including those specialising in larger commercial loans. Our Business Loan Calculator can help you understand the impact of borrowing larger amounts, and our application form can guide you toward lenders that are most likely to approve your specific requirements.

What if I can’t afford the monthly payments shown in the calculator?

If the business loan calculator shows payments that are unaffordable, consider adjusting the loan amount, extending the term, or exploring alternative finance options like asset finance or invoice funding. The Funding Options by Tide team can help you look at different funding structures that better match your cash flow capabilities.

We're here to help

Find the right Funding Options without affecting your credit score by filling out our quick and easy form.

See your Funding OptionsHow does it work?

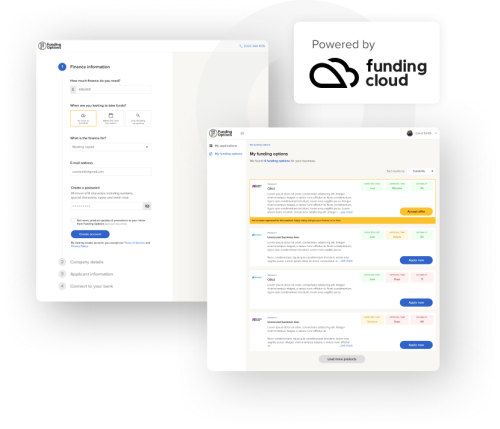

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.